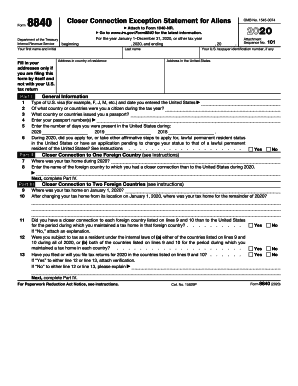

Canada GNB Form 81H free printable template

Show details

Form 81H APPENDIX OF FORMS FORM 81H RESPONSE TO MOTION TO CHANGE Court File No IN THE COURT OF QUEEN S BENCH OF NEW BRUNSWICK FAMILY DIVISION JUDICIAL DISTRICT OF SAINT JOHN BETWEEN Applicant s and Respondent s Address for service street and number city town village province postal code E-mail address if any Telephone number work Fax number if any Solicitor for applicant Name of solicitor for applicant province state country Solicitor for respond...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign document reply form

Edit your creditor format entity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditor signatures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit creditor format signatures online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit date filing order form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out creditor clarification signatures form

How to fill out Canada GNB Form 81H

01

Obtain a copy of the Canada GNB Form 81H from the official website or appropriate office.

02

Read the instructions carefully before you start filling out the form.

03

Fill in your personal details in the designated fields, such as name, address, and contact information.

04

Provide information about your status in Canada and relevant immigration details.

05

Include any required supporting documents as specified in the guidelines.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form either electronically or by mail as instructed.

Who needs Canada GNB Form 81H?

01

Individuals applying for a specific status or benefit related to their immigration or residency in Canada.

02

Those who are seeking to obtain certain government services or entitlements that require validation of their status.

Fill

document order court

: Try Risk Free

People Also Ask about canada child tax benefit application

What is simple filing?

A simple return is one that's filed using IRS Form 1040 only, without attaching any schedules.

What are 4 forms used in filing your taxes?

Form 1040. The U.S. Individual Income Tax Return is the bread and butter of tax forms -- the starting point for most taxpayers. Form 1040EZ. As the name suggests, the 1040EZ is a pretty basic individual filing tax form. Form 1040A. Form W-2. Form W-4. Form W-4P. Form 1099-MISC. Form 1098.

What is my IRS filing form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What are the three common forms for filing taxes?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS.

What are 4 items you need to file your tax returns?

Bring all documents below. Photo ID. Social Security Cards, Social Security Number verification letters, or Individual Taxpayer Identification Number assignment letters for you, your spouse, and any dependents. Birth dates for you, your spouse, and dependents on the tax return.

What are four 4 types of forms on federal taxes?

Popular Forms, Instructions & Publications Form 1040-ES. Estimated Tax for Individuals. Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax. Form 941. Employer's Quarterly Federal Tax Return. Form SS-4. Application for Employer Identification Number (EIN)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find order important form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the order form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete canada driver abstract form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ca 81h new brunswick response motion. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit respondent postal on an Android device?

With the pdfFiller Android app, you can edit, sign, and share rcmp form 6016 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Canada GNB Form 81H?

Canada GNB Form 81H is a form used in New Brunswick for individuals to report their income for the purpose of personal tax calculation.

Who is required to file Canada GNB Form 81H?

Individuals who reside in New Brunswick and have earned income during the tax year are required to file Canada GNB Form 81H.

How to fill out Canada GNB Form 81H?

To fill out Canada GNB Form 81H, individuals should gather their income documentation and follow the instructions provided on the form, ensuring all required information is accurately entered.

What is the purpose of Canada GNB Form 81H?

The purpose of Canada GNB Form 81H is to collect information necessary for the provincial government to assess an individual's income tax liability.

What information must be reported on Canada GNB Form 81H?

Individuals must report personal information, total income, deductions, and any relevant tax credits on Canada GNB Form 81H.

Fill out your Canada GNB Form 81H online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 81h is not the form you're looking for?Search for another form here.

Keywords relevant to date filed

Related to uk starter checklist

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.